The crypto market entered April with positive moves, possibly indicating the end of the bear market. However, the positive movements didn’t benefit Hedera (HBAR) and Polygon (MATIC), as both tokens suffered price decreases.

This decline has pushed many investors to Collateral Network (COLT), a new Web3 challenger currently poised to experience a 3500% price increase due to its immense popularity and real-world use cases.

Collateral Network (COLT)

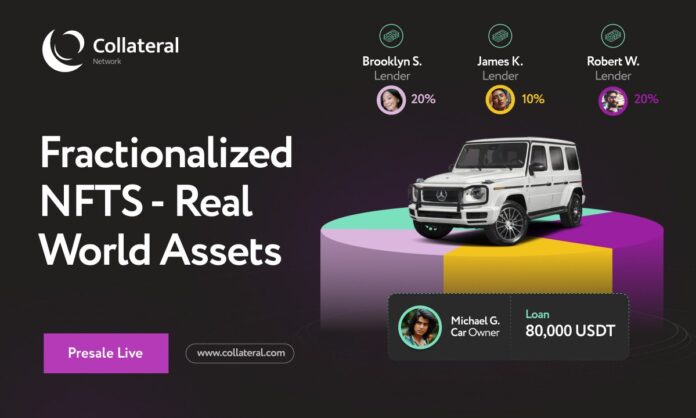

Collateral Network (COLT) has been making waves in the DeFi space with its innovative approach to lending. The platform’s ability to use physical assets as collateral through NFTs for peer-to-peer loans has made it a game-changer for borrowers and lenders alike.

The recent rise in Collateral Network (COLT) price can be attributed to its unique value proposition to investors. For instance, a borrower can use their $10,000 watch as collateral to unlock a short term loan via Collateral Network (COLT). Collateral Network (COLT) mints an NFT and fractionalizes it into smaller pieces. Investors interested in lending capital can purchase the fractions to collectively fund the loan, earning a fixed rate of interest.

If the user fails to repay the loan, the Collateral Network (COLT) sells the asset in an auction to return the money to the lenders. Furthermore, the platform’s exclusive online auctions for distressed assets allow investors to buy assets below market value. This feature has made Collateral Network (COLT) a top contender for any crypto portfolio in 2023.

The COLT token grants holders various benefits like staking, governance rights, and more, and has been trading at a very affordable price of $0.014 in its presale phase 2, up over 40%, and experts believe it can reach $0.35, which is a 3500% increase. With such tremendous growth potential, it’s no surprise that investors want to add Collateral Network (COLT) to their portfolios.

Hedera (HBAR)

Hedera (HBAR) has experienced a 5% drop at the time of writing, with a current market cap of $2.08b. With its low ROI, various analysts aren’t so bullish about Hedera’s (HBAR) short-term growth.

Hedera (HBAR) is currently trading near the value of $0.06, and the technical charts suggest a consolidated momentum in price. The Hashgraph consensus algorithm used by Hedera (HBAR) allows for faster and more energy-efficient transactions than other blockchains. This makes Hedera (HBAR) a great platform for high-volume gaming and social media applications.

The asset price of Hedera (HBAR) may fall below $0.05. But if the bulls can keep up the momentum, Hedera (HBAR) may see a short bounceback.

Polygon (MATIC)

Polygon (MATIC) has experienced a significant sell-off, indicating a potential decline in price. Blockchain data shows that approximately $109 million worth of Polygon (MATIC) has been transferred to Binance over the past few hours (at the time of writing). This is likely to create selling pressure that could negatively impact the price of Polygon (MATIC).

The 40 million Polygon (MATIC) whale transfer indicates that a large entity may be selling its holdings. Subsequent transfers of 30 million Polygon (MATIC) further confirmed the sell-off. Despite the recent sell-off, the long-term prospects for Polygon (MATIC) remain promising. However, Collateral Network (COLT) is a better choice than Polygon (MATIC), considering its recent price surge and bullish future.

Find out more about the Collateral Network presale here:

Website: https://www.collateralnetwork.io/

Presale: https://app.collateralnetwork.io/register

Telegram: https://t.me/collateralnwk

Twitter: https://twitter.com/Collateralnwk