Once the tax season comes, many American consumers need to think about filing their income taxes.

Financial assistance from the government doesn’t differ from getting a paycheck when it comes to taxes. Unemployment benefits should be included for those who received them.

Do you need more details on how to file your taxes correctly? Keep on reading to find out if you owe taxes on unemployment benefits and how to prepare for your tax bill.

How to Avoid Issues with the IRS

Similarly to your regular salary, unemployment benefits should be included in your tax file. This income is also considered taxable, so don’t forget to report it on your tax return.

If you are planning to file taxes for 2021, you need to remember to include this assistance in your taxable income for this year.

When our country was suffering from the global pandemic, this rule was tweaked in 2020. However, if an individual obtained financial aid from the government for unemployment in 2021, this income is also taxable.

The IRS and the federal government didn’t change this rule at the beginning of 2022. When you experience sudden monetary issues, you may take out a $1000 loan to fund your needs, but when you are laid off, you qualify for unemployment benefits.

Those without an emergency fund have more issues with staying financially afloat.

Consumers may have an opportunity to have income taxes held back from their unemployment checks when they file for unemployment.

Many people select this option. You shouldn’t worry though if you didn’t opt for this decision to hold income taxes back from the unemployment checks.

Those who were employed for most of the previous year can notice a rather small tax bill or a lowered tax return when they file.

Rules for Unemployment Income for Tax Year 2021

You may find additional information issued by the IRS about the exclusion of a certain sum from unemployment compensation.

If an individual’s modified adjusted gross income (ADJ) is less than $150,000, the American Rescue Plan Act lets them remove from income up to $10,200 of unemployment compensation paid in 2020.

In other words, a consumer won’t need to pay tax on unemployment compensation of $10,200 or less on their 2020 tax return only.

What Unemployment Benefits Include

What do unemployment benefits mean? This term is general and comprises insurance benefits that your state pays you while you are out of the workforce. Besides, it refers to railroad compensation assistance.

Moreover, it includes various payments issued to a consumer by the Federal Pandemic Unemployment Compensation and the Federal Unemployment Trust Fund.

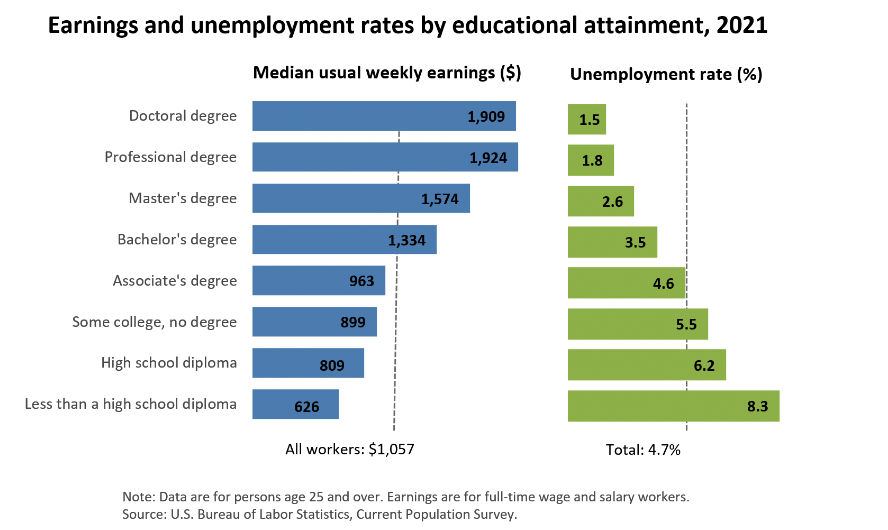

The Earnings and Unemployment Rates by Educational Attainment by the US Bureau of Labor Statistics state that the unemployment rate for the doctoral degree was 1.5% in 2021, while the rate for bachelor’s degree holders was 3.5% and for individuals with less than a high school diploma the unemployment rate was 8.3%.

Link: https://www.bls.gov/emp/chart-unemployment-earnings-education.htm

How You Should File Taxes after Getting Unemployment Benefits

Is there a way to understand the sum you owe after getting financial assistance for being unemployed? You need to prepare to file your taxes sooner rather than later. This is the easiest way to determine how much you owe.

Your state should provide you with Form 1099-G in case you obtained financial assistance while being out of work.

This form includes the data about the federal income tax a person selected to hold back and the sum they were given.

Do you choose to file your taxes with the help of a tax preparation service or tax software? We recommend you utilize these options as they are helpful and really easy.

The tax preparer needs to get a copy of the 1099-G Form from you. If you pick the software option, you will need to answer the question of whether you have obtained unemployment compensation within this year.

Reply positively, and the software will ask you to submit the amount using your form 1099-G.

Here is what you should do:

- Follow the instructions and fill out Form 1040 as normally.

- Fill out the data in Schedule 1 and mention the information about extra income such as unemployment compensation.

- Submit the sum of this compensation on line 7 of Schedule 1. This number can be found on Box 1 of the 1099-G form.

- Complete Schedule 1.

- Make sure you complete your 1040 form. Repeat the number from line 22 of Schedule 1 in line 10a of the 1040 form.

- Complete your 1040 form as usual.

State Income Taxes on Unemployment Compensation

Unemployment compensation is taxed in many states. Of course, there are a few exceptions. Maryland and Arkansas don’t charge state taxes on this type of compensation obtained in the tax year 2021, while other states do.

Make sure you check the information about the tax laws in your area to avoid mistakes as some states waived income tax on compensation obtained in 2021.

Those who reside in Nevada, Alaska, South Dakota, Texas, Florida, Wyoming, and Tennessee, don’t need to pay state tax on their unemployment benefits.

Keep in mind that it doesn’t refer to New Hampshire as regular income isn’t taxed here. You will only need to pay taxes on your investment income.

How Much Tax Should You Pay?

If you realize that you reside in an area where you should file tax on unemployment compensation, it’s reasonable to learn how much tax should be paid from your benefits.

In case a person gathers unemployment financial assistance, he may select if he wants to hold federal taxes back at a rate of 10%.

Particular states will let consumers hold back 5% of their state taxes. If a consumer doesn’t have taxes withdrawn from their unemployment compensation, he should pay taxes when he files an annual tax return or pays anticipated quarterly payments. In other words, not only your regular salary and paycheck are taxable but also your unemployment assistance.

The Bottom Line

When it comes to filing taxes on income, your regular salary doesn’t differ from getting unemployment compensation. These benefits should also be included in your tax return.

The American government allowed consumers not to include this assistance as their taxable income for the year 2020, but you should pay the full taxes on your unemployment benefits for the year 2021.

Keep in mind that certain states don’t tax this type of financial assistance while others do. If you want to avoid financial disruptions and be more confident in your future, it’s worth establishing an emergency fund.