By: Nick Gambino

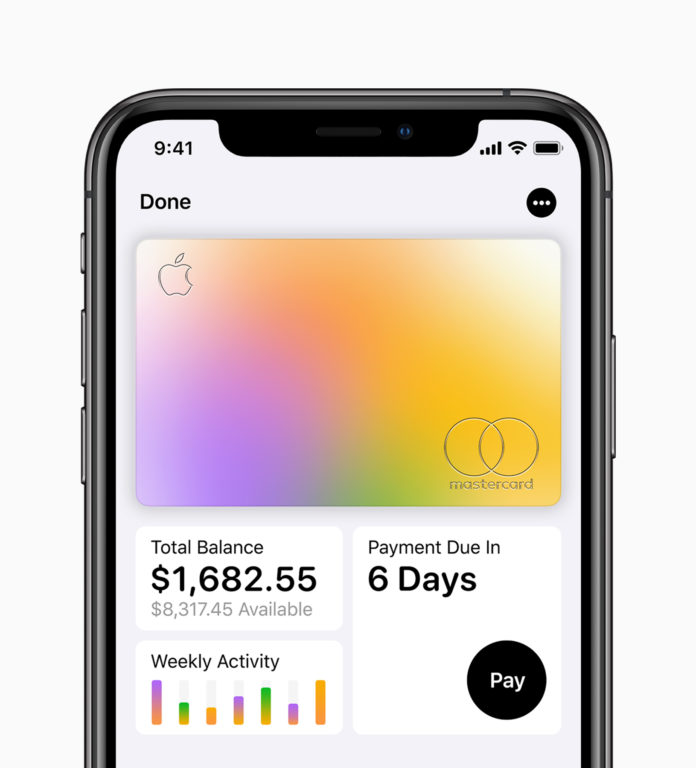

The Apple Card, announced earlier this year, has finally arrived. Users who received a special invite to apply from Apple can sign up for the new credit card right through the Wallet app. It shouldn’t take you longer than a few seconds and, if approved, you’re ready to start charging.

Only a select few received the invite from a pool of people who had signed up to be notified by e-mail when the card was available. A larger rollout is expected later this month.

This is a far cry from Apple Pay and mark’s the company’s first foray into finance with its partnership with Goldman Sachs and Mastercard. There are a number of pros to this card that will likely see a plethora of sign-ups right out the gate.

For starters, there are no late fees, annual fees or over-your-limit fees that you typically see with credit cards, which is nice. And much like the Amazon Rewards credit card, the Apple Card offers cash back known as Daily Cash. This hits your Apple Cash card in the Wallet every day and is ready for you to spend or transfer to your bank account a lot quicker than other cashback programs.

From what I gather they offer 3% cash back on any purchases made from Apple and 2% or 1% on other purchases made either digitally or using the physical titanium Apple Card. You’ll receive your slick, new titanium credit card in the mail after being approved. It’s most useful for purchases in locations where Apple Pay is not accepted.

Everything you buy using the card is categorized within the Wallet app making it easy for you to curtail spending. Each category gets its own color. Food and drinks will show up as pink, Entertainment is orange, etc.

When you’re ready to pay your monthly bill, the pay screen encourages you to pay less interest by providing a custom breakdown of how much you would need to pay overtime to avoid interest. This encourages paying more than the minimum payment and is a good reminder for those who have the means to pay more but don’t and wind up paying for it later.

Apple definitely swings for the fences with their first credit card and from all accounts they’ve knocked it out of the park in terms of user-friendliness and transparency.