Collateral Network (COLT) is a decentralized finance (DeFi) platform that is currently in the presale phase, allowing early investors to acquire tokens at a discounted rate. Despite increased price volatility for major cryptocurrencies like Ethereum (ETH) and Bitcoin (BTC), Collateral Network (COLT) is maintaining strong momentum in the cryptocurrency market. Let’s find out why.

Collateral Network (COLT)

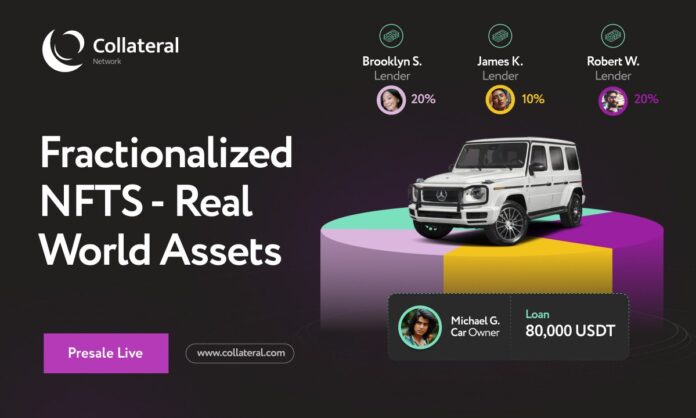

With Collateral Network (COLT), obtaining capital is easier than ever before. All that is required is an asset that has a higher value than the amount you intend to borrow. Collateral Network (COLT) will then mint a fractionalized non-fungible token (NFT) that represents your physical asset as collateral.

Collateral Network (COLT)’s innovative approach to collateralization eliminates the need for traditional lending practices such as credit checks, lengthy application processes, and high-interest rates.

By using an NFT to represent your asset, Collateral Network (COLT) enables fractional ownership, allowing multiple investors to invest in your collateralized asset. As such, Collateral Network (COLT) provides diversification for investors but also allows borrowers to access larger amounts of capital.

Collateral Network (COLT) also comes with a utility token, COLT, which is used to facilitate payments, incentivize users, and enable governance. The value of COLT is expected to increase as Collateral Network (COLT) attracts more users.

That’s why investors are rushing to the Collateral Network (COLT) presale, despite the values of Bitcoin (BTC) and Ethereum (ETH) going up and down. If Collateral Network (COLT) can continue to build on its current momentum, it could be the next big DeFi platform and revolutionize the crowdlending industry.

Ethereum (ETH)

As the pioneering platform for smart contracts, Ethereum (ETH) serves as a foundation for numerous decentralized finance (DeFi) initiatives and is taking cryptocurrency to new heights. Even with a wave of new competitors, Ethereum (ETH) stands firmly at the forefront as the most popular choice for DeFi protocols.

Ethereum (ETH) is becoming ever more attractive to developers and users with the development of Ethereum (ETH) 2.0, which will bring a host of improvements and scalability. This upgrade is expected to take place within the next two years, and its implementation will bring Ethereum (ETH) closer to mainstream adoption.

This week has been a tumultuous one for Ethereum (ETH) as its price corrected from $1,860 to its lowest point of below $1,700. Speculators believe that Ethereum (ETH) fell due to holders taking profits in the face of high market volatility. However, Ethereum (ETH) seems to be making a return to the highs, with a current price of $1,829.

Bitcoin (BTC)

Bitcoin (BTC) is the number one cryptocurrency in terms of market capitalization and popularity. Bitcoin (BTC) has been around for more than a decade and is still the go-to choice when it comes to investing in digital assets.

Like Ethereum (ETH), Bitcoin (BTC) dipped this week after a 30% move up to the high of $29,200. At the time of writing, Bitcoin (BTC) is trading at $28,400, with the asset trying to push higher.

Where Bitcoin (BTC) goes from here is anyone’s guess, but many are optimistic that the digital asset will recover and reach new heights. In the meantime, investors and users can take solace in the fact that Bitcoin (BTC) continues to maintain its footing as the world’s most popular cryptocurrency.

Find out more about the Collateral Network presale here:

Website: https://www.collateralnetwork.io/

Presale: https://app.collateralnetwork.io/register

Telegram: https://t.me/collateralnwk

Twitter: https://twitter.com/Collateralnwk