Welcome to Sixgrouptrust.com review, your go-to resource for starting your trading journey. Whether you’re a novice trader or looking to refine your skills, this guide will provide you with the foundational knowledge and tools to succeed in the world of trading.

Starting your trading journey can be both exciting and daunting. With the right tools, knowledge, and support, you can navigate the complexities of the market and make informed decisions. This guide, provided by Sixgrouptrust.com review, will walk you through the essentials of starting trading, the features you should look for in a trading platform, and how to maximize your success in the market.

Understanding Trading

Trading involves buying and selling financial instruments such as stocks, bonds, currencies, commodities, and derivatives. The goal is to capitalize on market movements to generate profits. There are various types of trading, including day trading, swing trading, and long-term investing, each requiring different strategies and approaches.

Getting Started with Trading Sixgrouptrust.com Reviews

Setting Up Your Trading Account

The first step in starting your trading journey is setting up a trading account. This process involves:

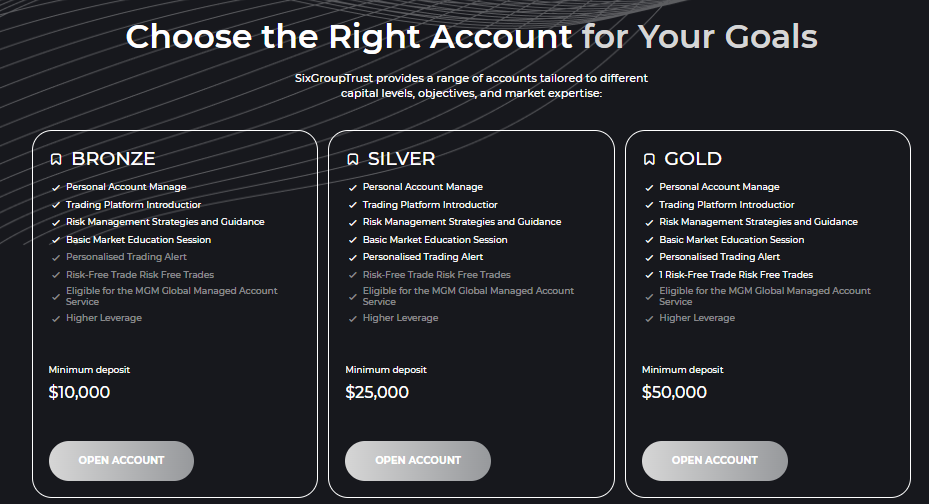

- Choosing a Broker: Select a reputable broker that suits your trading needs. Consider factors such as fees, available trading instruments, and the platform’s reputation.

- Account Types: Decide on the type of account you need, such as individual, joint, retirement, or margin accounts.

- Verification: Complete the necessary identity verification and compliance checks required by your chosen broker.

Choosing the Right Trading Platform

Selecting the right trading platform is crucial for your success. A good platform should offer:

- Ease of Use: An intuitive interface that simplifies trading.

- Tools and Features: Comprehensive tools for research, analysis, and executing trades.

- Security: Robust security measures to protect your data and funds.

- Support: Reliable customer support to assist with any issues.

Funding Your Account

After setting up your account, the next step is to fund it. Most brokers offer various funding options, including bank transfers, credit/debit cards, and electronic wallets. Ensure you understand the fees and processing times associated with each method.

Key Features of a Good Trading Platform Sixgrouptrust.com Reviews

User-Friendly Interface

A user-friendly interface is essential for efficient trading. Look for platforms that offer customizable dashboards, easy navigation, and quick access to trading tools. An intuitive interface allows you to focus on trading rather than figuring out how to use the platform.

Comprehensive Research Tools

Research is the backbone of successful trading. A good platform should provide access to:

- Market News: Up-to-date news and analysis from reliable sources.

- Technical Indicators: Tools for charting and technical analysis.

- Screeners: Advanced screeners to filter stocks and other instruments based on various criteria.

Real-Time Data and Alerts

Access to real-time data is critical for making timely decisions. Ensure your platform provides:

- Real-Time Quotes: Accurate and up-to-date pricing information.

- Market Alerts: Customizable alerts for price movements, news, and other market events.

Educational Resources

Continuous learning is vital in trading. Look for platforms that offer:

- Tutorials and Webinars: Educational content for all skill levels.

- Blogs and Articles: Regular updates and insights from market experts.

- Interactive Courses: In-depth courses covering various aspects of trading.

Customer Support

Reliable customer support is crucial for resolving issues quickly. A good platform should offer:

- 24/7 Support: Availability to assist you at any time.

- Multiple Channels: Support via chat, email, and phone.

- Knowledge Base: A comprehensive library of FAQs and guides.

Developing Your Trading Strategy Sixgrouptrust.com Reviews

Understanding Market Analysis

Successful trading requires a solid understanding of market analysis, which involves:

- Technical Analysis: Analyzing price charts and patterns to predict future movements.

- Fundamental Analysis: Evaluating a company’s financial health and performance.

Setting Goals and Risk Tolerance

Define your trading goals and risk tolerance. This involves:

- Short-Term vs. Long-Term Goals: Deciding whether you aim for quick profits or long-term growth.

- Risk Management: Setting stop-loss and take-profit levels to manage your risk.

Backtesting and Paper Trading

Before risking real money, practice your strategies using:

- Backtesting: Testing your strategies using historical data.

- Paper Trading: Simulating trades in a risk-free environment.

Executing Trades

Types of Orders

Understanding the different types of orders is essential for executing trades effectively:

- Market Orders: Buying or selling at the current market price.

- Limit Orders: Setting a specific price at which you want to buy or sell.

- Stop Orders: Triggering a buy or sell once a specific price is reached.

Managing Your Portfolio

Effective portfolio management involves:

- Diversification: Spreading your investments across different assets to reduce risk.

- Regular Review: Continuously monitoring and adjusting your portfolio based on market conditions.

Monitoring Market Trends

Stay informed about market trends by:

- Following News: Keeping up with financial news and economic indicators.

- Using Technical Indicators: Utilizing tools like moving averages and relative strength index (RSI).

Advanced Trading Techniques Sixgrouptrust.com Reviews

Technical Analysis

Technical analysis involves studying price charts and patterns to predict future price movements. Key concepts include:

- Chart Patterns: Recognizing patterns such as head and shoulders, double tops, and triangles.

- Indicators: Using tools like moving averages, Bollinger Bands, and MACD.

Fundamental Analysis

Fundamental analysis focuses on evaluating a company’s intrinsic value. Key factors include:

- Financial Statements: Analyzing income statements, balance sheets, and cash flow statements.

- Economic Indicators: Assessing factors like GDP growth, inflation rates, and interest rates.

Using Leverage

Leverage allows you to control a larger position with a smaller amount of capital. However, it comes with increased risk. Understand the margin requirements and potential for losses before using leverage.

Hedging

Hedging involves taking an offsetting position to reduce the risk of adverse price movements in an asset. Common hedging strategies include:

- Options: Using call and put options to hedge against potential losses.

- Futures Contracts: Locking in prices for assets to protect against future price fluctuations.

Automated Trading

Automated trading involves using algorithms to execute trades based on predefined criteria. Benefits include:

- Speed: Executing trades faster than manual trading.

- Consistency: Removing emotional biases from trading decisions.

- Efficiency: Managing multiple trades simultaneously.

Managing Emotions in Trading Sixgrouptrust.com Reviews

Emotional control is crucial in trading. Common emotions that can affect trading decisions include fear, greed, and overconfidence. Strategies to manage emotions include:

- Developing a Trading Plan: Having a clear plan with predefined entry and exit points.

- Sticking to Your Strategy: Avoiding impulsive decisions based on short-term market movements.

- Taking Breaks: Stepping away from trading to clear your mind and reduce stress.

The Importance of Continuous Learning

The financial markets are constantly evolving, and staying updated with the latest trends and developments is essential. Continuous learning can be achieved through:

- Reading Books and Articles: Staying informed about trading strategies and market analysis.

- Attending Seminars and Webinars: Learning from experts and gaining new perspectives.

- Joining Trading Communities: Sharing experiences and learning from other traders.

Conclusion

Starting your trading journey requires careful planning, continuous learning, and the right tools. By following this comprehensive guide from Sixgrouptrust.com review, you can build a solid foundation for your trading career. Remember to stay disciplined, manage your risk, and continually refine your strategies. Happy trading!

This guide provides a thorough overview of starting your trading journey, focusing on the essentials and advanced techniques needed to succeed. By following the steps and tips outlined, you’ll be well-equipped to navigate the markets and achieve your trading goals.