A BIN checker is a tool that helps identify the bank, country, and type of a bank card. Knowing this information reduces the risks of fraud and payment errors. Financial security is crucial for everyone, from individual users to large companies. You can learn how to use a BIN checker in our article.

Understanding BIN and Its Functions

A Bank Identification Number (BIN) consists of the first 6-8 digits on a payment card. It contains information about:

- The issuing bank’s name,

- The country of the card’s issuance,

- The type of card (debit or credit),

- The payment system (Visa, Mastercard, etc.),

- The card level (classic, premium, etc.).

This information is vital for identifying cards, and each digit has its significance.

- First digit: Indicates the type of card and payment system. For example, a ‘4’ represents Visa cards, ‘5’ is for Mastercard, and ‘6’ is for Discover.

- Second digit: Defines the card category, distinguishing between debit and credit cards for Visa and Mastercard.

- Third and fourth digits: Typically indicate the issuing bank. Each financial institution is assigned a unique code to differentiate it from others.

- Fifth and sixth digits: Show the country where the card was issued.

- Seventh and eighth digits: Often denote additional card features, such as average spending or the percentage of declined payments, which can be crucial for businesses.

How to Use the BIN Checker: Pulse from PSTNET

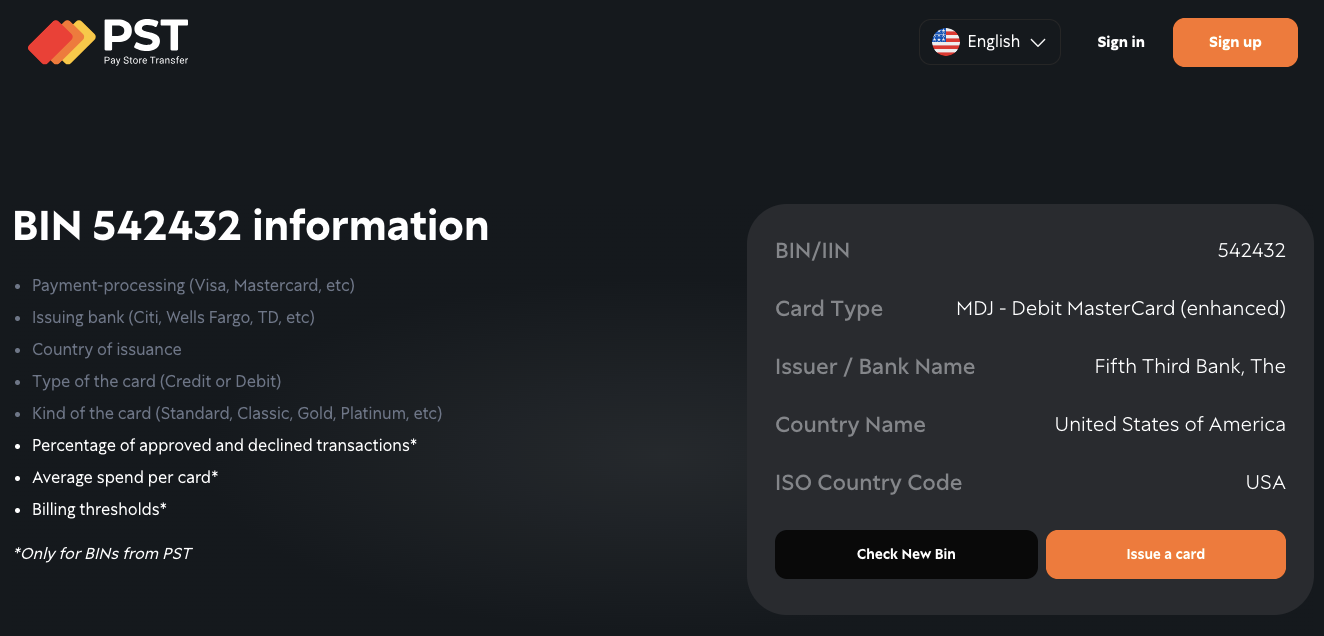

Let’s see what information is encoded in the BIN 542432.

For our check, we’ll use the free BIN checker from the financial service PSTNET, called “Pulse.”

Pulse provides access to details about the issuing bank, the country of issuance, the card type, card level, transaction approval rates, and average spending volumes. It updates its database daily and contains over 500,000 BINs.

We enter the digits into the BIN checker’s field and click “Check.” Instantly, the BIN checker analyses the numbers and matches them against its database. All relevant information will be displayed on the screen.

Why Check BINs in 2024?

Checking BINs helps identify cards that use unauthorised payment methods or cards from high-fraud countries. Experts argue that regular BIN checks can prevent significant losses and improve financial planning.

Frequent use of BIN checkers helps companies mitigate risks and enhance analytics. For instance, they prevent payment chargebacks and account suspensions on advertising platforms due to incorrect payment cards.

Conclusion

BIN checks are especially important for anyone dealing with online payments, whether individual users or businesses. A BIN checker helps avoid fraud or mistakes related to card usage. The interest in this tool is expected to grow, in line with the increasing volume of online payments.

According to Statista, the total transaction value in the digital payments market is projected to reach USD 17.72 trillion in 2024. It is also forecasted that the total transaction value will show an annual growth rate (CAGR 2024-2029) of 15.71%, resulting in a projected total amount of USD 36.75 trillion by 2029.