The rapid evolution of financial technology—fintech—has fundamentally reshaped the landscape of personal finance. In a world where digital solutions dominate, managing debt, particularly credit card debt, requires both strategic insights and technological savvy.

As of the second quarter of 2024, US credit card debt stands at an alarming $1.142 trillion, underscoring the urgency for effective financial management strategies. For consumers burdened by high-interest credit card balances, digital tools and platforms offer innovative solutions like credit card consolidation, transforming how people manage debt, budget, and plan for their financial futures.

Here, we discuss the evolution of personal financial management in the digital age, highlighting smart money moves individuals can employ to navigate debt repayment and secure financial freedom.

The Evolution of Personal Finance Management

Personal finance management has come a long way from the days of balancing checkbooks and manually tracking expenses. The advent of digital banking, financial apps, and robo-advisors has made managing money more accessible and efficient.

Consumers now have access to real-time financial data, enabling them to precisely monitor spending, track investments, and plan for significant life events.

The rise of fintech has disrupted traditional banking concepts, offering consumers innovative ways to handle their finances. From mobile banking apps to AI-powered budgeting tools, technology has simplified personal finance and empowered consumers to take charge of their financial well-being.

However, despite these advancements, a National Financial Educators Council report depicts lagging financial literacy. It says 38 percent of its surveyed individuals admitted that a lack of financial literacy cost them a minimum loss of $500 in 2022. Moreover, 15 percent of the same respondents said it lost them a hefty $10,000 or more. One aspect of personal finance that continues to challenge many is debt—specifically, credit card debt.

The Immensity of Credit Card Debt

Credit card debt is one of the most common forms of consumer debt, and its scale is staggering. Globally, credit card debt continues to balloon as consumers increasingly rely on credit for everyday expenses amid rising inflation and stagnant wage growth.

For the average American, carrying a credit card balance month-to-month has become the norm. According to the latest Credit Card Debt Survey by Bankrate, 50 percent of US credit card holders carry their credit card debt from month to month as of June 2024, up from 44 percent in January. According to Bankrate’s polling, it is the highest percentage since March 2020.

High interest rates can reach 15 to 25 percent, exacerbating this burden. As of the first week of September 24, the average credit card interest rate in the US reached 27.64%. As a result, millions of people find themselves trapped in a cycle of debt, paying substantial sums in interest without making significant progress on the principal.

This debt burden is not confined to the US. In the UK, total credit card debt hit £70.31 billion in 2023, with a similar trend of high interest rates contributing to financial strain. Across Europe and Asia, credit card debt continues to rise, propelled by increased consumerism and the availability of easy credit.

The situation has left many consumers seeking effective strategies for debt relief, with credit card consolidation emerging as a powerful instrument for alleviating this financial strain.

The Role of Technology in Debt Management

Technology is vital in reshaping how individuals approach debt repayment, budgeting, and financial planning in the digital age. Apps and online platforms now offer sophisticated tools to help users manage their finances, including debt consolidation.

Debt repayment tools

The rise of debt management apps has revolutionized how consumers tackle credit card balances. These apps can analyze a user’s credit cards, prioritize payments based on interest rates, and manage payments to minimize interest costs. This automation provides users with the peace of mind that their debt is being managed efficiently without constant oversight.

Budgeting and planning apps

Budgeting is essential to debt management, and apps have simplified the process. These tools allow users to categorize expenses, track income, and create debt repayment goals. With real-time financial insights, users can identify areas to cut costs and allocate more funds toward paying down debt.

Credit monitoring platforms

Maintaining a robust credit score is the foundation for accessing favorable credit card consolidation options. Some platforms provide free credit score monitoring, helping consumers stay in control of their credit health. By offering personalized tips to improve credit scores, these fintech tools empower users to make informed financial decisions and increase their chances of securing low-interest consolidation loans.

Innovative Strategies for Managing Debt in the Digital Age

As technology advances, consumers increasingly adopt innovative strategies to manage their debt more effectively. Here are some fundamental approaches to consider:

Automating debt payments

Automation is one of the most potent tools in debt management. By setting up automatic payments through apps like Prism or a bank’s autopay feature, consumers can ensure they never miss a payment. This helps prevent late fees and contributes to a positive credit history, crucial for securing favorable credit card consolidation terms.

Snowball vs. avalanche methods

Two popular debt repayment strategies are the snowball and avalanche methods. The snowball method involves starting with payments directed to the smallest debts. On the other hand, the avalanche method of debt repayment prioritizes paying off debts with the highest interest rates.

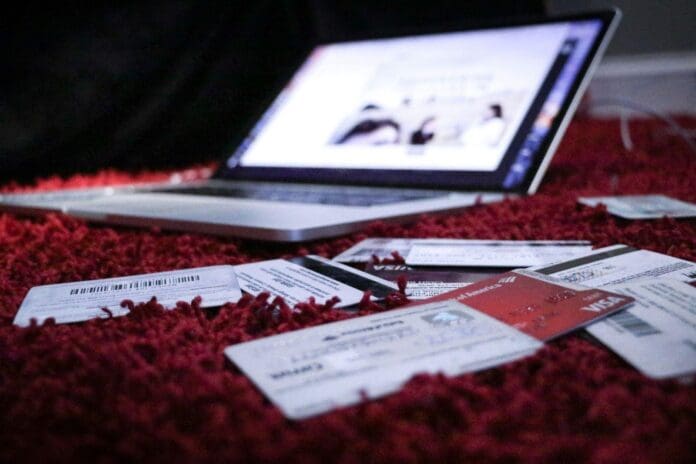

Credit card consolidation: A lifeline for debt relief

One of the most promising strategies for managing overwhelming credit card debt is credit card consolidation. This financial tactic involves combining multiple high-interest credit card balances into a single unified loan or credit line with a lower interest rate, thereby reducing the overall cost of debt.

Photo by Stephen Phillips – Hostreviews.co.uk on Unsplash

Credit card consolidation works by streamlining debt payments, allowing consumers to focus on a single monthly payment rather than juggling multiple due dates and interest rates.

Consumers who opt for credit card consolidation can lower their interest rates, leading to substantial savings over time. Some can accelerate their debt repayment timelines. Consolidating debt also improves one’s credit score, as timely consolidated loan payments can positively impact credit history.

The rise of online personal finance companies that tackle credit card debt

In addition to the proliferation of apps and platforms, online personal finance companies have emerged as key players in the debt consolidation space. These companies offer innovative loan services to help consumers lower their monthly payments and reduce high-interest credit card debt.

SoFi, for example, is a fintech company that provides personal loans tailored for credit card consolidation. With competitive interest rates, swift application, and flexible loan repayment terms, SoFi offers a streamlined online application process. Consumers can apply for loans within minutes and receive funds quickly, making it an attractive option for those aiming to consolidate their credit card debt.

Other platforms offer novel lending models like peer-to-peer lending, connecting borrowers with individual lenders. Others use artificial intelligence to assess loan applicants’ creditworthiness, offering personal loans that can be used for credit card consolidation. Analyzing factors beyond traditional credit scores, such as education and employment history, provides more personalized loan options for consumers with diverse financial backgrounds.

Financial Freedom in the Digital Era: Using the Right Tools to Get Out of Debt

The digital age has changed how individuals manage debt and work toward financial freedom. With access to a vast array of fintech digital tools, apps, and online services, consumers have more control over their economic destinies than ever before. However, it’s essential to approach debt management with a clear strategy, particularly regarding credit card consolidation.

By consolidating their high-interest credit card debt into a single, lower-interest loan, consumers can simplify their finances, decrease their monthly payments, and pay off debt more quickly. In combination with budgeting apps, automated payments, and financial coaching, credit card consolidation offers a path to economic stability.

As the financial landscape advances, staying informed and leveraging digital solutions will be vital to achieving financial freedom. With the proper tools and strategies, managing debt in the digital age is possible and can be a powerful stepping stone toward a brighter financial future.