Today, decision-making by finance leaders requires clear reasoning and a sustainable vision than ever before. In order to stay ahead in the race, businesses are increasingly compelled to embrace data to mitigate the threats posed by their technologically advanced competitors and changing business landscape. Therefore, companies across all industries are turning towards qualified and professional finance experts who can navigate complex data sets and determine the steps needed to satisfy their clients’ waning requirements. Meet the Virtual CFO (Chief Financial Officer) – your strategic finance partner – who utilizes data analytics and ensures that raw financial data is converted into meaningful and actionable insights.

This blog will focus on exploring how Virtual CFOs can use data analytics to make informed business decisions and drive business growth, while keeping their company’s financial health in check. Ready to discover the immense potential that data can offer a business? Let’s dive in!

What Is a Virtual CFO?

Before we dive into the role of data analytics in today’s business landscape, let’s first take a moment to understand the role of a Virtual CFO.

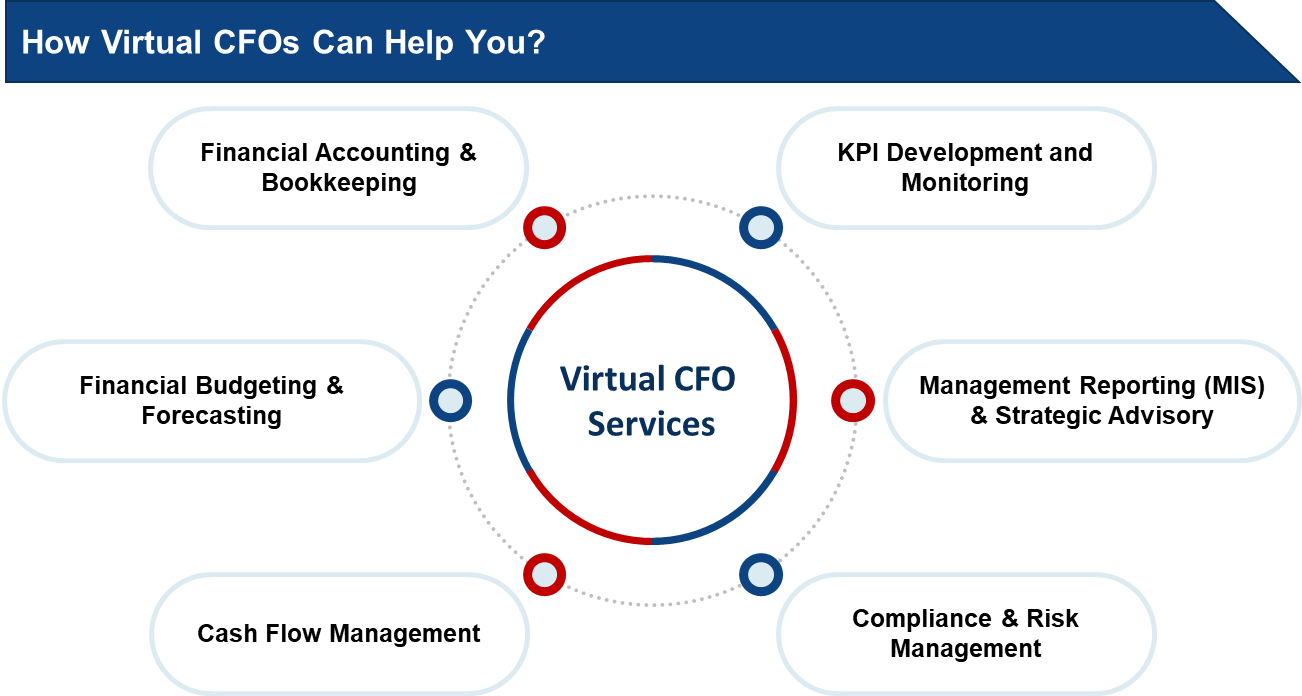

A Virtual CFO is an outsourced financial expert offering high-level financial management and advisory services that are typically performed by an in-house CFO. These services are provided remotely to companies that need greater financial expertise but don’t require a full-time CFO or lack the resources to hire a person of similar nature.

The Influence of Data Analytics in Financial Decision-Making

Data analytics is transforming the way businesses manage their finances. It is regarded as a very effective tool for financial decision-making because of its capacity to sift through vast volumes of data for insights that highlight trends, identify possible risks, and explain why certain outcomes might occur.

Virtual CFOs are increasingly adopting data analytics to:

- Analyse historical trends

- Forecast future financial conditions

- Identify inefficiencies and opportunities for growth

- Enhance budgeting and cash flow control

Here are some examples of using data analytics and automation to optimize various finance processes:

| Finance Function | Optimizing Process |

| Managing and Processing Client Billing |

|

| AR, Collections, Cash and Bank Reconciliation | Automate the entire workflow of ERP data entries:

|

| Managing Accounts Payable |

|

| Financial Statement Closure and Representation |

|

How Do Virtual CFOs Leverage Data Analytics?

Is your company’s future growth driven by data and finance? Virtual CFOs can help you spot hidden opportunities and avoid potential pitfalls.

Consider a cash management scenario where a medium-sized manufacturing firm seeks the assistance of a Virtual CFO. What additional benefit do you think this manufacturing firm could gain by outsourcing this task as opposed to relying on their in-house finance department?

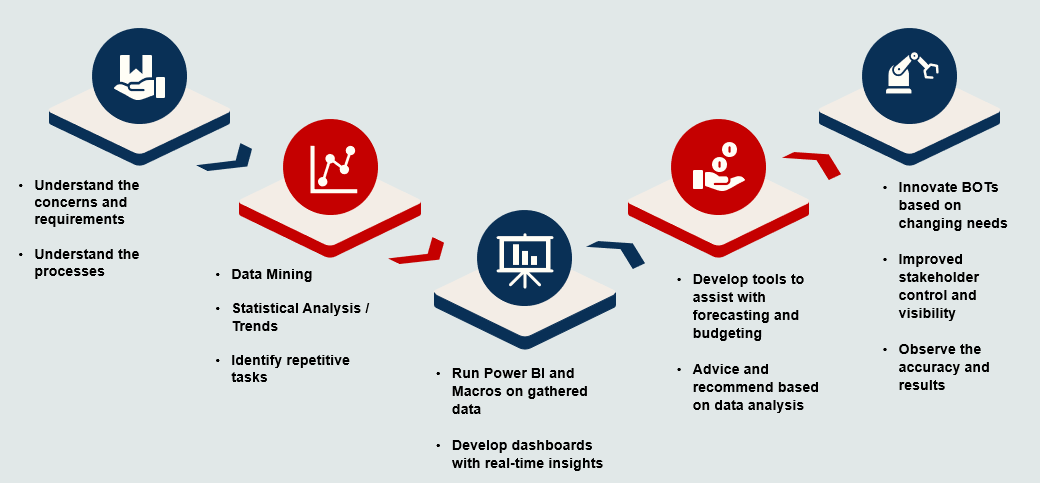

Common Steps Virtual CFOs Use to Automate and Analyse Data

By examining the company’s historical sales data, the Virtual CFO was able to construct a cash flow estimate model by identifying trends in customer payments. Since cash flow deficit was anticipated, the manufacturing firm was able to inform their clients about the revised payment schedule at a prior notice. As a result, they were able to enhance liquidity which enabled them to buy new production equipment without incurring any new debt.

This is just the tip of the iceberg on how virtual CFOs apply data analytics to enhance financial management. Let’s dissect a few areas where data analytics is harnessed to enable better decision-making:

- Cash Flow Optimization

Virtual CFOs make use of data to analyse the patterns in cash flow cycles and project future cash requirements. This allows them to tweak working capital and be sure that company has enough assets that can be readily converted into cash to fulfil its needs and support continued expansion.

- Forecasting and Trend Analysis

Virtual CFOs can determine future events, trends or results by analysing past financial data. For instance, they can forecast seasonal dips in revenues or recognize trends in sales and help businesses change strategies ahead of time.

- Cost Control and Budgeting

Data analytics tools are used by Virtual CFOs to track spending in real time and pinpoint areas for cost reduction. This data-driven approach ensures that firms maintain control over their cost structure and keep the profit margins high. - Profitability Analysis

By analysing profit margins, cost of goods sold (COGS) and various other parameters, Virtual CFOs can pinpoint areas where businesses can increase profitability. For example, depending on data insights, they may recommend altering pricing strategies or switching suppliers.

Benefits of Data Analytics for Businesses

Using data analytics through Virtual CFO services offers many benefits. Here are a few key advantages:

- Smarter Choices: Companies can make better-informed decisions with precise and current financial data. This helps them cut down on risks and make the most of the available opportunities.

- Better Rule-Following: Data analytics helps businesses stick to regulations by keeping an eye on the mandatory compliances and reporting money matters as and when they happen.

- Smoother Operations: Virtual CFOs apply data to make processes run better, cut down on waste, and boost output across departments.

- More Money: Insights from data lead to smarter pricing, better cost control, and more accurate income predictions, ultimately boosting profits.

How would your financial choices change if you could access data analytics in real time?

The Digital Toolbox for Virtual CFOs

With the right tool, everything else falls into place. Does your analytics software have the power to transform your financial processes?

Virtual CFOs deploy a variety of tools to fully harness the potential of data analytics. Some of the most popular ones include:

- QuickBooks: An easy-to-use accounting software that provides real-time insights about the different aspects of a business’ financial performance.

- Tableau: A powerful tool for data visualization, helping Virtual CFOs present financial data in a clear, easy-to-grasp way.

- Power BI: A business analytics tool that allows Virtual CFOs to monitor, dig into, and share financial data effortlessly.

- Xero: A cloud-based accounting software that makes managing finances simpler and boosts teamwork between the Virtual CFO and your staff.

To wrap up, Virtual CFOs are increasingly leveraging the power of data analytics to help businesses make smarter, more strategic financial decisions. Insights driven through data, if utilized effectively, can change the course of how companies, both small and big, manage their finances – from making cash flow better to looking at how profitable things are.

Do you want to experience the magic of a Virtual CFO?

With a Virtual CFO by your side, you can modify your approach towards financial decision making and fuel your business growth. To find out how we can help you maximize your financial figures by unlocking the potential of data, get in touch with us right now!