The U.S. Securities and Exchange Commission is looking to crack down on cryptocurrency. Kraken has already been forced to close its staking service in the US following payment of a $30 million settlement to the SEC, with projects like Monero (XMR) and Stacks (STX) also showing concerns.

However, Collateral Network (COLT) seems unphased with stricter regulation, presenting a new DeFi application to the market that analysts have forecasted to surge by up to 35x.

Monero (XMR) Security Could Cause SEC Dispute

Monero (XMR) is one of the most secure DeFi projects in the world. With a focus on investor privacy, Monero (XMR) lets investors trade cryptocurrency without revealing any personal data. Monero (XMR) takes privacy to the next level and is so secure that Monero (XMR) has actually damaged its own reputation, being used for illicit activity on the darknet marketplace.

Despite making headlines following this activity, Monero (XMR) has remained a popular investment option, with daily trading volume averaging $70 million. Over the past few weeks, Monero (XMR) trading volume has declined, which could suggest fear of regulation is starting to impact its community. However, many analysts are attributing this decline in Monero (XMR) to general market trends.

Stacks (STX) Looks To Build The Bitcoin Blockchain

Stacks (STX) is a Bitcoin Layer designed for smart contracts, which lets decentralized applications (dApps) use Bitcoin (BTC) to settle transactions. This gives Bitcoin (BTC) a whole new application in the DeFi market, meaning Stacks (STX) could revolutionize how investors interact with Bitcoin (BTC).

Stacks (STX) uses a Proof of Transfer consensus and a Clarity language to read the Bitcoin blockchain at any time. While this all sounds good, transactions made on the Stacks (STX) layer are secured by Bitcoin hashpower, which could be problematic when it comes to regulation.

Nonetheless, Stacks (STX) outperformed the whole cryptocurrency market in February, increasing in value by 113.78%. Stacks (STX) has spiked trading volume and has currently removed any concerns about the impact future regulations could make, as Stacks (STX) continues to grow in popularity.

SEC Regulation Unlikely To Impact Collateral Network (COLT), Set To Explode With 35x Returns

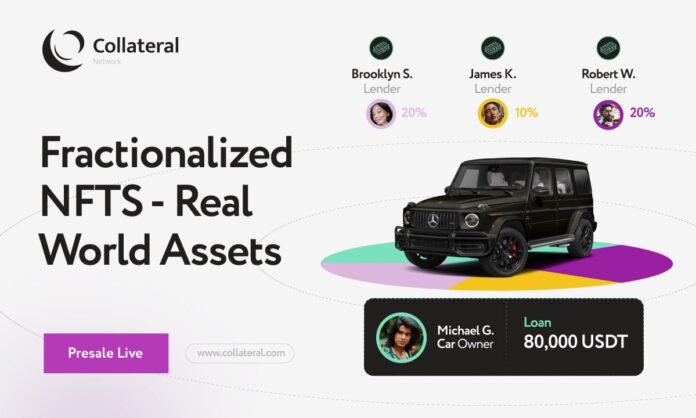

Collateral Network (COLT) is a new DeFi project that looks to revolutionize the crowdlending industry. As the world’s first challenger lender, Collateral Network (COLT) seeks to streamline the process of unlocking liquidity from real-world assets.

Unlocking liquidity from assets is currently a long-winded process, often taking weeks to complete, and can also significantly impact a borrower’s credit. With Collateral Network (COLT), borrowers can receive their money in 24 hours without leaving a trail on their credit report.

Borrowers start by choosing the asset they want to borrow against, such as real estate, vehicles, fine wines, art, fine whiskey, diamonds, and gold.

Should the asset holder want to take out a short-term loan, they can mint a tangible NFT backed by their physical asset. This NFT is then fractionalized so investors can become lenders while earning a passive income with a fixed interest rate.

The Collateral Network (COLT) ecosystem will include a marketplace where borrowers can connect with investors, auctions where COLT token holders can purchase distressed assets at below market value, and a crowdlending platform where investors can earn a passive income. As well as this, COLT holders will be able to enjoy benefits like staking bonuses, governance rights, discounts, access to exclusive VIP groups and more.

Collateral Network (COLT) is currently in the first phase of its presale, selling for $0.01. Market analysts speculate that Collateral Network (COLT) could surge by 3,500% in the next few months, offering huge returns to bullish investors who get involved early.

Find out more about the Collateral Network presale here:

Website: https://www.collateralnetwork.io/

Presale: https://app.collateralnetwork.io/register

Telegram: https://t.me/collateralnwk

Twitter: https://twitter.com/Collateralnwk