Better business finances: a myth or an attainable goal? Despite how it might seem, there are always more ways you can streamline your finances. By doing so, you can remove excess and waste from your expenses and enable your budget to go further without cutting corners.

With customers cutting their spending and the climate looking slightly uncertain across a range of sectors, what can you do to prevent the economic impact from irrevocably damaging your business?

Eliminate Redundancies

Repeating identical tasks, engaging in activities that result in prolonged completion times and aren’t essential, and multiple sign-offs through different management levels can be a source of frustration for employees. However, by identifying and eliminating these redundancies, you can significantly reduce wasted time and resources, leading to a more efficient and streamlined business operation.

You need to look at every process from beginning to end and how it reaches completion. Are people repeating things as they move through the task? Are too many people involved, or are there easier ways to get things done? By evaluating how you operate, you can find instances where resources and time are being wasted and eliminate them.

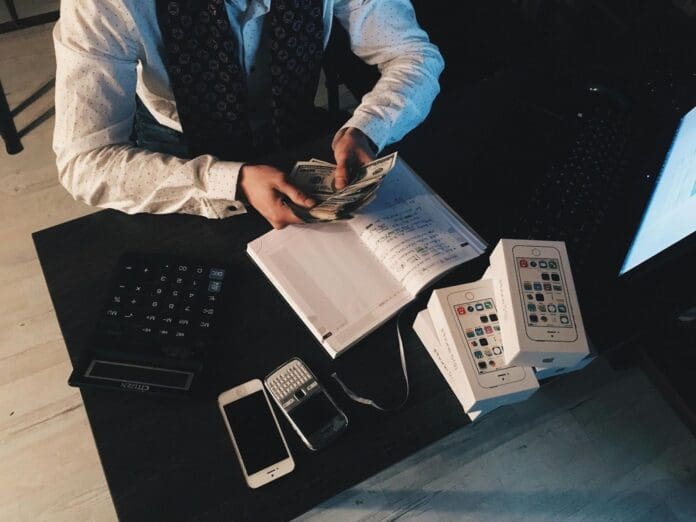

Create A Cash Flow Forecast

A cash flow forecast can help you pinpoint gaps in your cash flow and forecast future funds and trends based on historical data. The more you can anticipate changes in cash flow, the easier it will be for you to support those quieter periods and adjust your spending or activities.

You want to create a predictable cash flow, and one way to do this is via an accounts payable schedule. An automated accounts payable solution means you can rest assured that all invoices are collected from the source and input into the system without any need for human intervention except for reviewing them. Not only does this save time and improve efficiency, but it can also reduce human error and cust costs associated with paper-based workflows. Software like DOKKA’s Acumatica integration can facilitate improved accounts payable processes for improved results and more accurate cash flow forecasts.

Understand Business Expenses

It’s not just about knowing what you’re paying for, but truly understanding your business expenses. By identifying the costs vital to your business’s core and delivering customer value, you can protect and prioritize them in your budget. This understanding empowers you to make informed financial decisions and allocate funds where they can make the most impact.

By doing so, you can sidestep excessive price increases, enabling you to be more competitive and avoid alienating your customers.

Review Expenses

Following on from the above, while you need to be aware of the core expenses you have within your business, you also need to know all the costs and ascertain whether they’re actually essential or not. Move aside your core expenses and look at those that aren’t explicitly integral to what you do or offer value.

Look at each payment with fresh eyes. If you were starting your business again today, would you include this payment? What value, if anything, does it offer you? Do you actually need to pay for it? Everything you pay for in relation to your business needs to have a justifiable ROI to make it worthwhile.

Identify Waste

In addition to removing inefficiency and repetition from your processes, you need to start looking at other areas of waste within your business. Is your scheduling not optimized, leading to wasted wages? Can you remove waste from your wage bill by restructuring schedules or eliminating staff who don’t provide value and aren’t essential? While redundancies aren’t great for a company, identifying people who can be utilized within the company in other roles can help reduce this, as can letting go of staff who are problematic or a drain on resources via following the correct termination process if applicable.

Other examples include wasted materials, equipment, and procedures. Can you use more than you currently are or build up a surplus in good items to accommodate those times when the market isn’t favorable? Can you reuse or sell resources you are using or that aren’t essential to what you do?

Pay Down Debt

If cash flow is a concern, then it can be a good idea to address business debt levels and interest rates associated with your debt, too. Start with the highest interest rate loans or credit have aggressively paid it down. It will eat into your cash flow initially; however, once it’s paid off, it will free up funds to be directed for other uses, including paying down other debts. You might also be able to take out a consolidation loan to manage payments at a lower interest rate if you have good business credit.

Lean Management

Lean management principles, which focus on reducing waste and improving efficiency, can help you reduce excess inventory. By paying close attention to your opening and closing stocks, you can avoid holding onto excess inventory or slow-selling items. This can help you identify if you need to make changes to your stock to reduce the overheads associated with holding onto it.

Strategic Pricing

Strategic pricing is a powerful tool in your financial arsenal. By analyzing your pricing structure, your competitors’ prices, and customer value perceptions, you can implement a pricing model that maximizes your profits while justifying the value to your customers. This strategic approach to pricing can make you feel in control of your business’s financial health and confident in your pricing decisions.

Revenue Investment

While investing in activities that boost revenue might seem counter-intuitive, especially if budgets are on the tight side, you shouldn’t be neglecting initiatives that can directly increase revenue. This is your marketing and sales part of the business. The reality is that even though you’re looking to cut costs and get your finances under control, you will need to bring in money, and marketing and sales are an integral part of this. Cutting back in these areas can do more damage than good in the long term, so always ensure there’s still a budget available to invest in these areas.