Photo by Milan Csizmadia on Unsplash

By: Nick Gambino

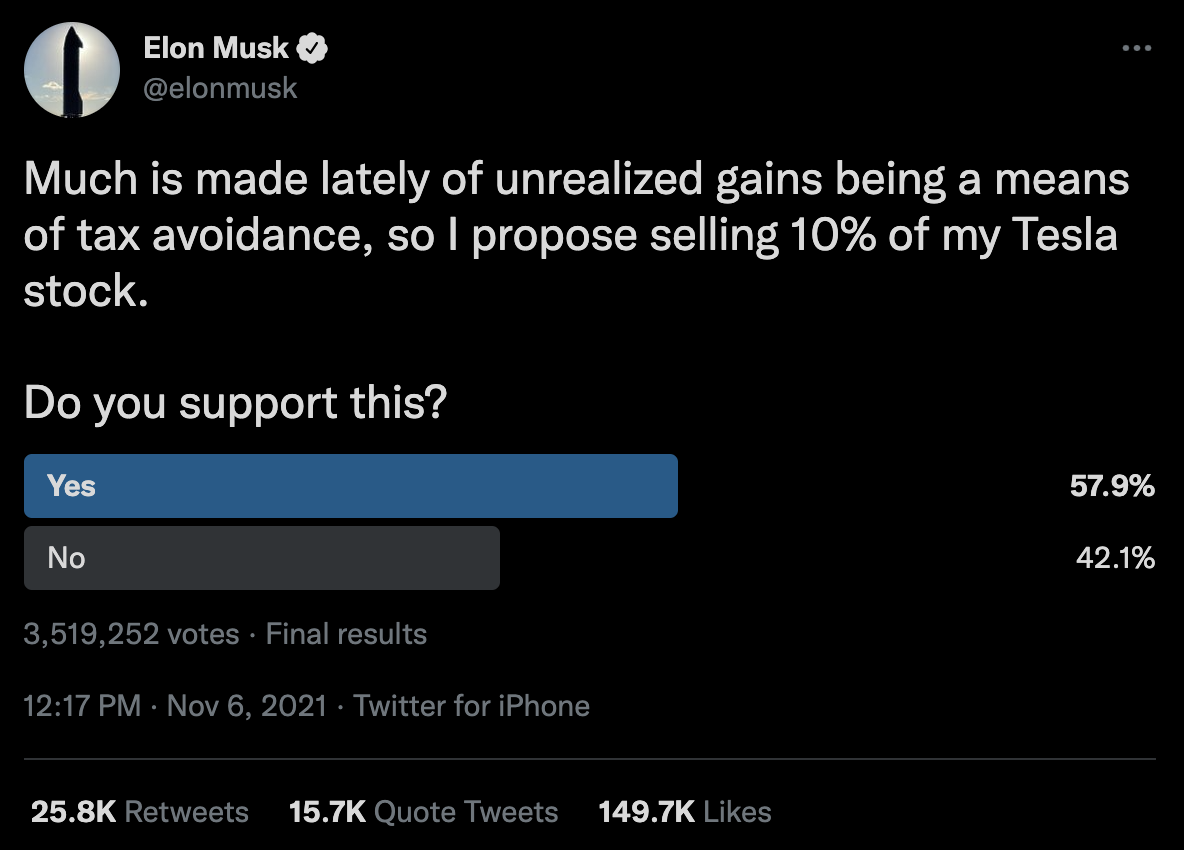

In true Elon fashion, the Tesla CEO posted a Twitter poll asking his 63.4 million followers whether he should sell or not. He promised to abide by the results of the poll.

“Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock,” the Twitter poll reads. “I will abide by the results of this poll, whichever way it goes. Note, I do not take a cash salary or bonus from anywhere. I only have stock, thus the only way for me to pay taxes personally is to sell stock.”

The poll ended at 58% “Yes” and 42% “No.” Without another word, the enigmatic billionaire sold 4.5 million shares of Tesla stock worth over $5 billion. Now that would put a pretty dent in nearly anyone’s stock portfolio, but it only represented 3% of Elon’s stake in the EV company.

If you’re doing the math or simply paying attention, you’ll notice that figure is not the 10% he promised to sell in his original tweet. After selling the 3% early in the week, he then sold off another 639,737 shares on Thursday equal to about $687 million. So we can expect he will continue to sell.

After the dust settled, Elon still retains 167 million shares of Tesla which is worth about $147,682,000,000 as of this writing. And while the stock price took a 13% dip this week it’s recovering nicely and should be just fine after this little dustup.

Much has been speculated about why Elon is actually selling all this stock. Yes, the Twitter poll is cute, but it seems he was planning on selling anyway. He’s currently staring down the barrel of a more than $11 billion federal tax bill that he needs cash to pay. 22.9 million of his stock options are expiring in August 2022 so once he exercises those options (which he most certainly will or else he loses them) he’ll have to pay taxes on the value.

Most of the time when someone exercises options, they are taxed on the lower capital gains rate, but because Elon owns more than 10% of the total shares of Tesla, it’s subject to income tax.

So, it’s most likely not about the results of a random Twitter poll but rather a necessity for cash. That’s the only thing that makes sense. Why else would he be liquidating so much in one go?