In an era marked by growing environmental concerns and a pressing need for sustainable solutions, the Green Revolution has taken center stage. This movement not only strives to mitigate climate change but also addresses the economic challenges associated with it. As stakeholders seek innovative ways to invest in sustainable practices, the intersection of agriculture and green investing opens up a world of opportunities. One such avenue is the immediate-revolution.org, an online trading platform that enables investors to engage in commodity futures with a sustainable twist.

Sustainability in Agriculture: The Need for Change

The Challenge of Conventional Agriculture

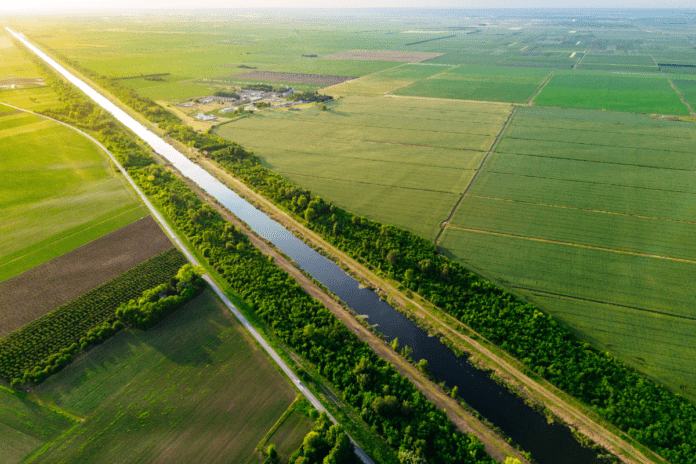

Conventional agriculture has long been associated with practices that harm the environment. Pesticides, chemical fertilizers, and extensive water usage have not only damaged ecosystems but also put pressure on commodity markets. Climate change has disrupted traditional crop cycles, leading to increased price volatility and scarcity. To address these challenges, a shift towards sustainable agriculture practices is imperative.

The Rise of Sustainable Agriculture

Sustainable Farming Practices

Sustainable agriculture emphasizes a holistic approach to farming that conserves natural resources, minimizes environmental impact, and ensures economic viability. Practices such as organic farming, crop rotation, and precision agriculture help reduce carbon footprints, conserve water, and maintain soil health. These techniques are not just environmentally friendly but also offer long-term economic benefits for farmers.

The Role of Commodity Futures in Sustainable Agriculture

Understanding Commodity Futures

Commodity futures involve contracts for the future delivery of specific goods at predetermined prices. These contracts play a significant role in the agriculture sector, allowing farmers and other stakeholders to hedge against price fluctuations. In the context of sustainable agriculture, commodity futures can be instrumental in securing stable income for farmers while promoting green practices.

The Green Revolution in Commodity Futures

Sustainability-Linked Commodity Futures

Sustainability-linked commodity futures are an innovative financial instrument designed to support sustainable agriculture. These contracts are linked to the environmental performance of the farming practices associated with the underlying commodities. In essence, they reward farmers who adopt green practices by offering better prices for their produce.

Investing in Sustainable Agriculture

The Intersection of Sustainability and Finance

An online trading platform recognizes the importance of sustainable agriculture and provides an avenue for investors to support it. This platform allows users to engage in sustainability-linked commodity futures, thereby participating in the Green Revolution while potentially benefiting financially.

Key Features of Online Trading Platform for Green Investors

- Easy Accessibility: Online platform is user-friendly and accessible to investors of all levels, making it a convenient choice for those interested in sustainability-linked commodity futures.

- Risk Management: The platform provides risk management tools that help investors navigate the commodity futures market with confidence.

- Sustainability Metrics: Investors can track the sustainability performance of the commodities they invest in, ensuring their support for environmentally friendly farming practices.

- Potential for Profit: By supporting sustainable agriculture and reaping the benefits of commodity futures, users of online platform have the opportunity to profit while driving positive change.

The Future of Green Investing

Aligning Profit and Sustainability

The Green Revolution, powered by innovative solutions like sustainability-linked commodity futures, is reshaping the landscape of green investing. Investors no longer need to choose between financial gains and environmental responsibility. With platforms, they can align their profit motives with their commitment to sustainability.

Expanding Opportunities

As the demand for sustainable agriculture grows, so do the investment opportunities. Sustainability-linked commodity futures offer a way for investors to diversify their portfolios while promoting a greener and more secure future for agriculture.

Conclusion

The Green Revolution is more than just a catchphrase; it is a movement that holds the key to a sustainable future. By supporting sustainability-linked commodity futures through platforms like Crypto Loophole, investors can play a pivotal role in advancing green agriculture practices. The intersection of finance and environmental responsibility has never been more promising, offering the potential for profit alongside the fulfillment of a noble cause. The time is ripe to be a part of this transformation and ensure that sustainable agriculture remains at the forefront of the commodity futures market. With the growing recognition of sustainability’s importance, this movement is set to gain momentum, offering substantial opportunities for all those involved. Through other similar platforms, investors can actively contribute to the Green Revolution while securing their financial future.